In an era where blockchain interoperability is no longer a luxury but a necessity, native cross-chain protocols emerge as the cornerstone of the next evolutionary phase in decentralized finance (DeFi). This breakthrough eliminates the reliance on intermediaries, wrapped tokens, or centralized exchanges. Imagine a scenario where assets like BTC, ETH, and SOL intermingle in a seamless dance of liquidity across multiple blockchains.

Native cross-chain swaps are transforming DeFi by enabling direct transfers of assets between blockchains, bypassing the need for wrapped assets or centralized exchanges. This evolution offers several key benefits:

Enhanced Liquidity: By pooling resources from multiple blockchains, these swaps create deeper asset pools, leading to better pricing and narrower spreads.

Superior Swap Rates: Removing intermediaries cuts transaction costs and slippage, leading to more favorable rates for users.

Greater Asset Control: Users maintain ownership of their assets, reducing risks linked to third-party failures.

Expanded Functionality and Accessibility: These swaps facilitate the integration of diverse blockchain assets and functions, making DeFi more user-friendly and accessible.

DEX vs. CEX: The Shifting Landscape

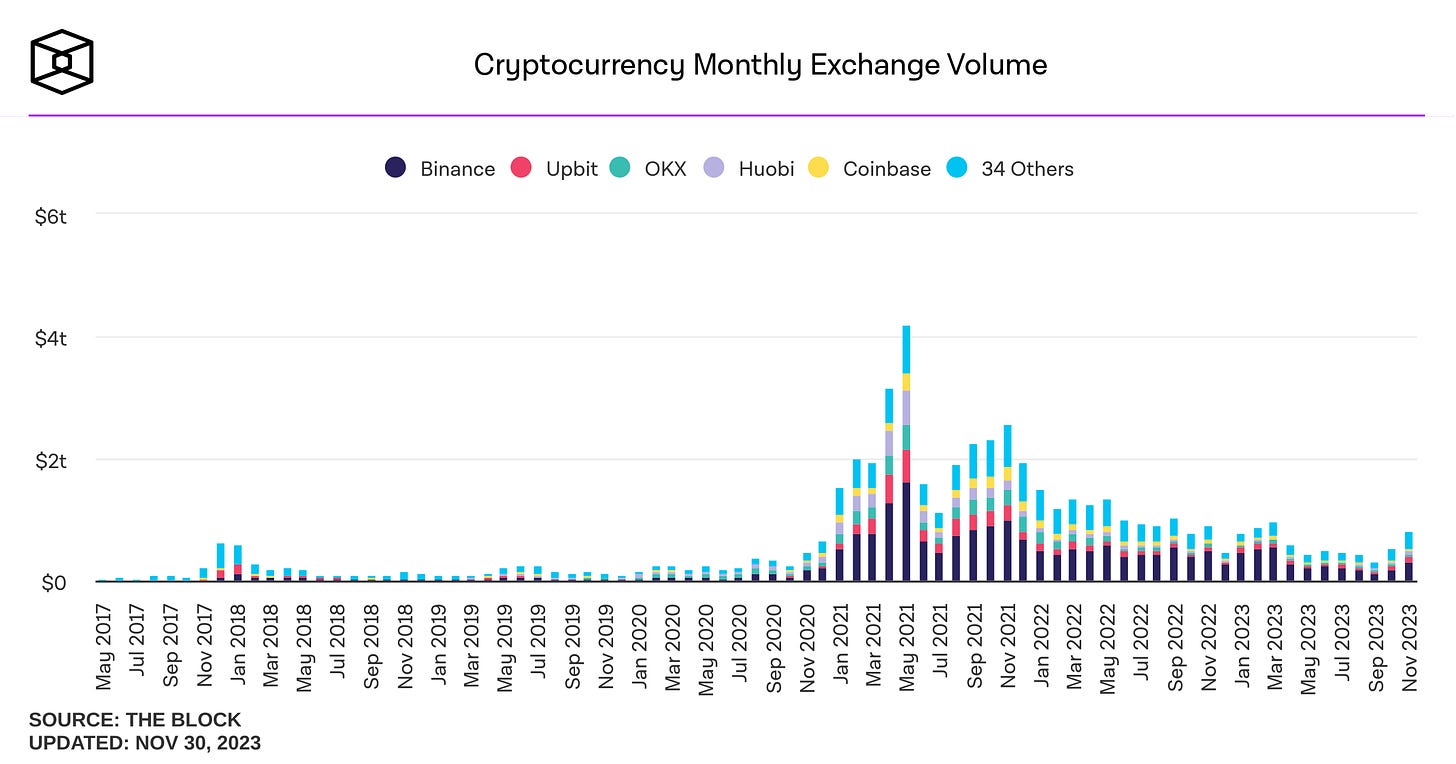

Spot Market Volume: The Opportunity

The transition from CEXs to DEXs is accelerating, with the spot volume ratio surging to over 15%. Driven by their inherent benefits, DEXs are increasingly favored and are expected to capture even more market share due to recent CeFi shake-ups. In the near future, we anticipate that DEXs will manage over a quarter of the market's spot volume, amounting to trillions in USD of monthly volume at the peak.

Native Cross-Chain Swaps: The New Frontier

The future of DeFi lies in seamless asset transfers across different blockchains, a challenge that native cross-chain swaps are solving. Protocols like THORChain, Chainflip, Maya Protocol, and Serai DEX are leading the way, enabling swaps across different blockchains without the need for intermediaries via wrapped tokens or centralized exchanges.

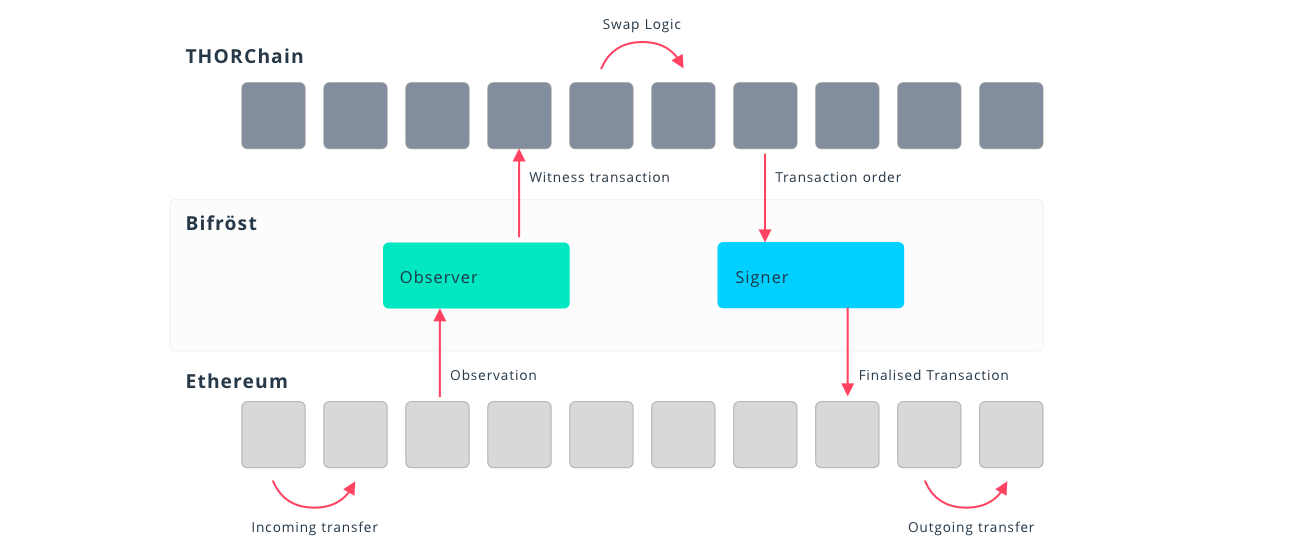

THORChain: Pioneering Native Cross-Chain Swaps

THORChain leads the charge in the realm of native cross-chain swaps as a pioneering decentralized liquidity protocol. It operates on the Cosmos SDK, utilizing the Tendermint consensus mechanism and the GG20 Threshold Signature Scheme (TSS). As an independent Layer-1 cross-chain DEX, THORChain enables the exchange of native assets across diverse blockchains, bypassing the need for wrapped or pegged tokens. The protocol ensures transparent and competitive pricing, independent of centralized third parties, and its continuous liquidity pools enhance trading efficiency. In essence, THORChain functions much like a cross-chain version of an Automated Market Maker (AMM), comparable to Uniswap, allowing for direct asset exchange across different blockchains.

THORChain's recent introduction of streaming swaps has propelled its trading volume to unprecedented heights. Streaming swaps allow it to efficiently handle multi-million dollar swaps with as low as 5 basis points in fees. This not only underscores its efficiency in handling large transactions but also cements its rising status in the DEX landscape.

Swap Volume

Unique Users

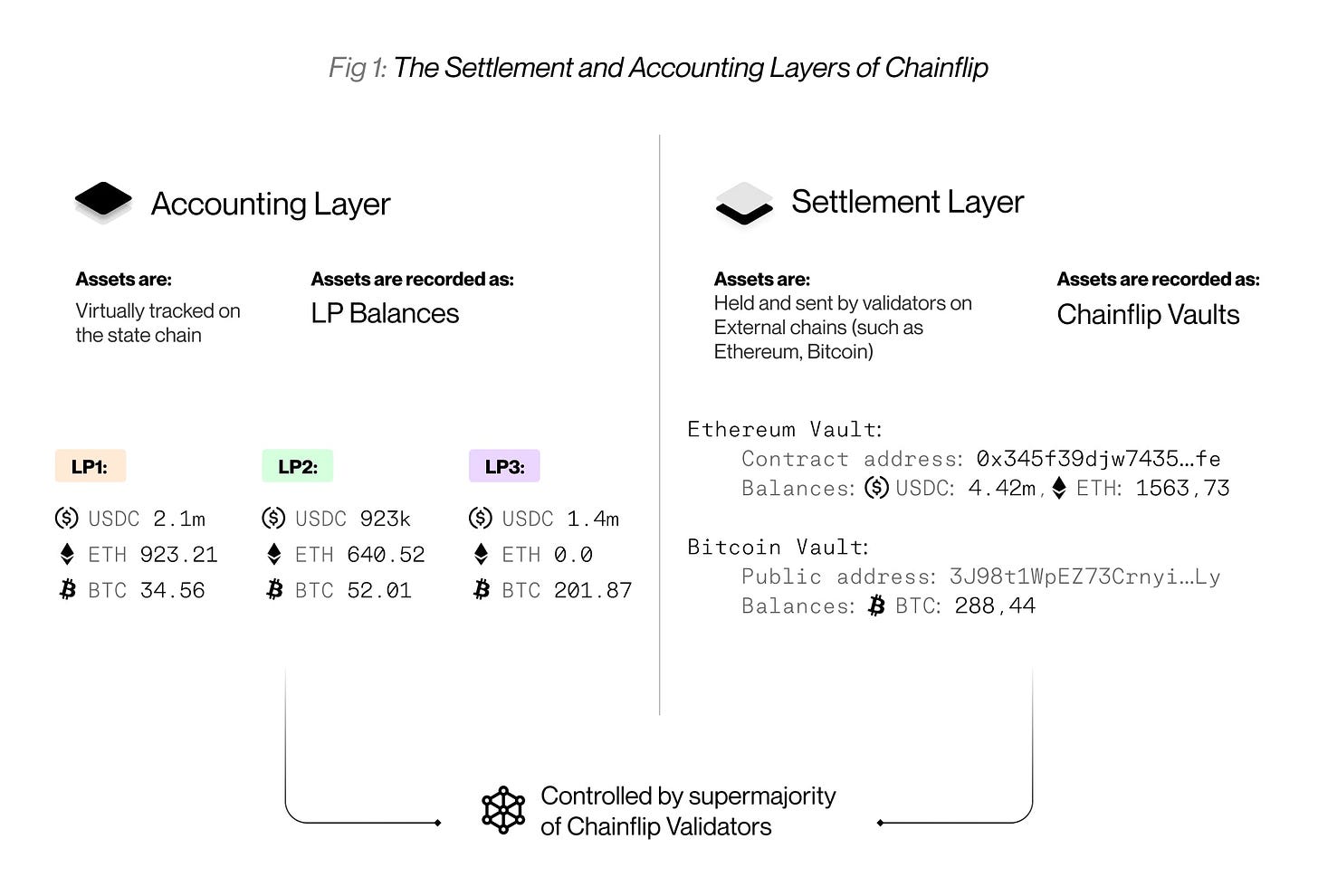

Chainflip: The Battle for Best Price Execution

Newly launched, Chainflip introduces a fresh perspective in the cross-chain asset swap sector, setting itself apart from THORChain. Utilizing FROST for its Threshold Signature Scheme (TSS) enhances both security and efficiency. The platform's unique Just In Time (JIT) AMM is specifically designed for optimal price execution for swaps. As Chainflip prepares to enable swapping functionality, it will be intriguing to observe its performance and impact in the realm of cross-chain DeFi.

Maya Protocol: A Friendly Fork

Maya Protocol is a fork of THORChain, featuring changes for greater capital efficiency and different chain integrations. Consequently, Maya Protocol contributes to expanding the native cross-chain pie, offering a more efficient alternative in the DeFi ecosystem.

Serai: Cross-Chain Privacy

Serai, focusing on Monero integration for enhanced privacy, is set to launch soon. It supports Bitcoin and Ethereum and plans to expand to more networks. Notably, Serai uses FROST for its Threshold Signature Scheme (TSS) mechanism, aligning with Chainflip's approach to security and efficiency.

Conclusion

In the realm of DeFi, native cross-chain protocols like THORChain, Chainflip, Maya Protocol, and Serai are rapidly becoming the industry's liquidity backbone. Each protocol, with its unique strengths, is expanding the scope and efficiency of cross-chain swaps. As these platforms continue to evolve, their pooled liquidity will be pivotal for various market players, ranging from frontends, aggregators, wallets, DEXs, to even CEXs. This integration signifies a monumental shift towards seamless, decentralized asset transfers across blockchains, reshaping the financial landscape.

We're stepping into an era where these protocols are not just facilitators but essential pillars of the DeFi ecosystem.

DISCLAIMER

This site is not intended to provide any investment, financial, legal, regulatory, accounting, tax or similar advice, and nothing on this site should be construed as a recommendation by Sour Capital Pte. Ltd. (“Sour Capital”), its affiliates, or any third party, to acquire or dispose of any investment or security, or to engage in any investment strategy or transaction. An investment in any strategy involves a high degree of risk and there is always the possibility of loss, including the loss of principal. Nothing in this site may be considered as an offer or solicitation to purchase or sell securities or other services.